what is maryland earned income credit

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. It is different from a tax deduction which reduces the amount of.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Maryland Refundable EIC is worth 40 million more this tax season.

. The Earned Income Tax. See what makes us different. Ad Get the most out of your income tax refund.

Tips Services To Get More Back From Income Tax Credit. In 2019 25 million taxpayers received about. It is a special program for low and moderate-income persons who have been employed in the last tax year.

Earned Income Credit - EIC. 36 rows States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

What is the Earned Income Credit. Eligibility and credit amount depends on your income. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. R allowed the bill to take effect without his signature. If you qualify for the federal earned income tax credit and.

We dont make judgments or prescribe specific policies. See Marylands EITC information page. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state. The program is administered by. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

The Maryland earned income tax credit EITC will either reduce or eliminate. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people. Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax year.

If you qualify you can use the credit to reduce the taxes you owe. If you qualify for the federal earned income. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The maximum federal credit is 6728. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

If you qualify for the federal earned income tax credit and.

More Childless Adults Are Eligible For Earned Income Tax Credit Eitc

Earned Income Credit Tax Law Changes For Tax Year 2021 And Beyond Tax Pro Center Intuit

What Is The Earned Income Credit Check City

.png)

What Is The Earned Income Credit Check City

Earned Income Tax Credit Eitc Interactive And Resources

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Check Out The Caleitc Eligibility Chart To See If You Qualify For Ca S Newest Earned Income Tax Credit Link Http C Community College Income Tax Tax Credits

Earned Income Credit Eitc Definition Who Qualifies Nerdwallet

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How Older Adults Can Benefit From The Earned Income Tax Credit

Summary Of Eitc Letters Notices H R Block

Earned Income Tax Credit Now Available To Seniors Without Dependents

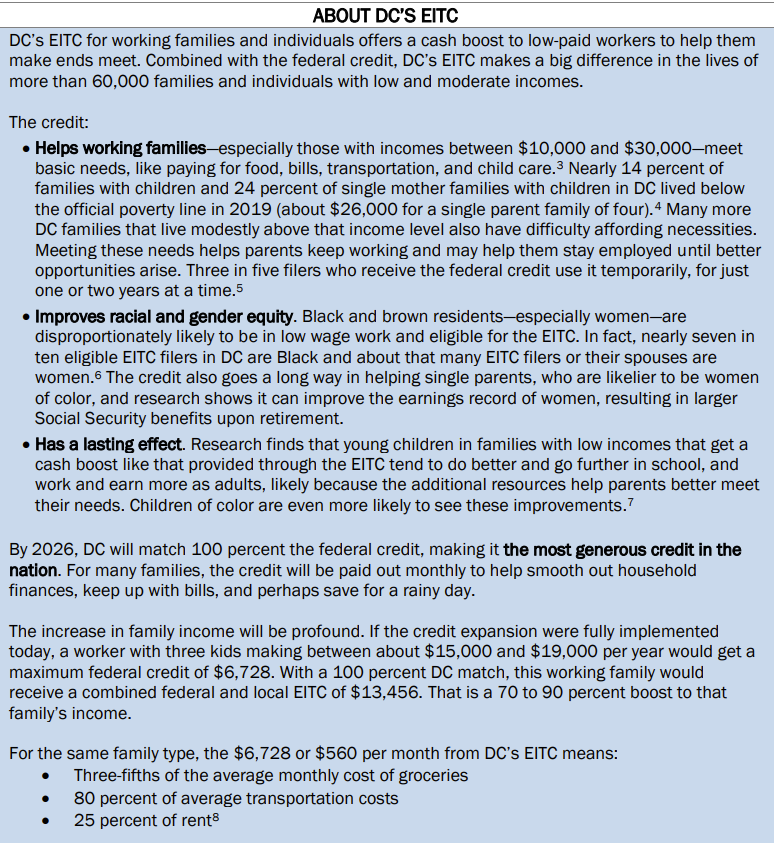

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

Earned Income Tax Credit Who Qualifies Changes For 2022

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep